Bedford's title loan market offers an alternative financing option using vehicle equity, appealing to those with urgent financial needs who may not qualify for traditional bank loans. Reputable lenders, like Bedford Title Loans, provide transparent, flexible terms and same-day funding, ensuring residents can access cash quickly while keeping their cars, avoiding San Antonio's repossession risks. Prioritize established companies with positive client feedback when selecting a provider.

In today’s financial landscape, Bedford title loans have emerged as a viable option for quick cash access. This article delves into the dynamic market of Bedford title loan providers, equipping readers with insights to make informed decisions. We explore key factors that distinguish top-rated companies and provide an in-depth comparison, highlighting the benefits and risks associated with this alternative financing method. By understanding the market, you can navigate Bedford’s title loan landscape with confidence.

- Exploring Bedford's Title Loan Market

- Key Factors in Choosing a Provider

- Top-Rated Bedford Title Loan Companies Compared

Exploring Bedford's Title Loan Market

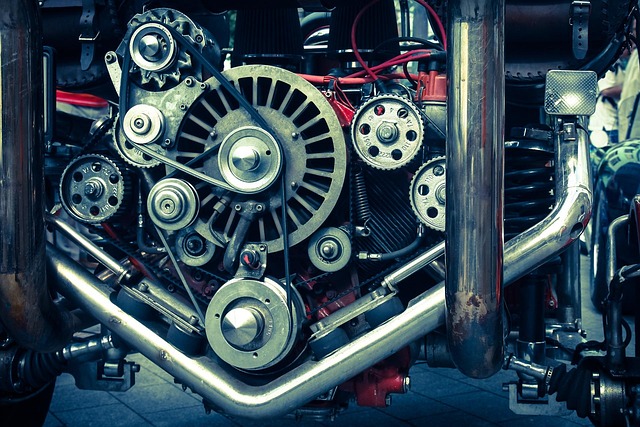

Bedford’s title loan market is a dynamic and evolving sector, reflecting the city’s diverse financial needs and vehicle ownership landscape. As more residents explore alternative financing options, Bedford title loans have gained prominence as a quick solution for those looking to access immediate cash using their vehicle’s equity. These loans are particularly attractive to folks who may not qualify for traditional bank loans or who need money in a hurry.

The appeal of Bedford title loans lies in their simplicity and accessibility. Lenders offer these loans by leveraging the value of an individual’s motor vehicle, ensuring that borrowers can keep their vehicle while receiving much-needed funds. This is a significant advantage compared to San Antonio loans, where vehicles might be repossessed upon default. By understanding the local market and choosing reputable lenders, Bedford residents can navigate this option wisely, catering to immediate financial obligations without sacrificing their cherished modes of transportation.

Key Factors in Choosing a Provider

When choosing a provider for Bedford title loans, several key factors come into play. Firstly, consider the reputation and experience of the lender. Opting for an established company with a proven track record ensures trustworthiness and fairness in the loan process. Check reviews and feedback from previous clients to gauge their satisfaction levels. Additionally, understanding the types of loans offered is vital. Some providers specialize in motorcycle title loans or other specific asset-backed financing options, catering to diverse needs.

The speed and convenience of funding are also significant advantages. Same-day funding can be a game-changer for those needing quick access to cash. This feature ensures that you receive your loan proceeds promptly, enabling you to manage unexpected expenses or seize time-sensitive opportunities. Furthermore, evaluating the terms and conditions, including interest rates, repayment plans, and any potential penalties, is crucial before committing to a lender. Transparent practices and flexible options for loan extensions can provide peace of mind throughout the entire process.

Top-Rated Bedford Title Loan Companies Compared

When it comes to finding top-rated Bedford title loan companies, several options stand out for their reliability and customer satisfaction. These lenders specialize in providing short-term funding secured by a vehicle’s title, offering a convenient solution for those needing emergency funds quickly. Among the leading players in this sector, Bedford Title Loans has garnered attention for its transparent practices and efficient loan approval process.

The company distinguishes itself through a straightforward application process, where borrowers can apply online or visit one of their local offices. Once approved, the title transfer is handled swiftly, ensuring that customers receive their funds promptly. This accessibility and speed make Bedford Title Loans an attractive choice for individuals seeking immediate financial assistance without the usual lengthy waiting periods associated with traditional loans.

When comparing Bedford title loan providers, it’s clear that understanding your financial needs and evaluating key factors is essential. By considering aspects like interest rates, loan terms, and customer reviews, you can make an informed decision. The top-rated Bedford title loan companies reviewed here offer competitive options, ensuring you access the funds you need efficiently. Remember, when it comes to Bedford title loans, choosing a reputable provider can significantly impact your financial experience.