Bedford title loans provide fast financial support using vehicle titles as collateral, with streamlined approvals and flexible terms. Applicants submit an application, document their vehicle, and lenders assess its value. Approved borrowers receive funds, typically a percentage of their car's worth, with online applications available. However, it's crucial to understand interest rates, repayment conditions, and associated fees to avoid financial risks. Prioritize responsible borrowing practices and get multiple appraisals for fair value. Demand transparent information from lenders and seek advice from trusted sources for informed decisions.

“Bedford title loans can offer quick cash solutions, but understanding the process and avoiding common pitfalls is crucial. This article guides you through the basics of Bedford title loans, highlighting potential traps to steer clear of. By learning about your rights as a borrower, you can make informed decisions. We provide essential insights to ensure you navigate this alternative financing option safely, offering a comprehensive guide to help borrowers protect themselves in the world of Bedford title loans.”

- Understanding Bedford Title Loans: The Basics

- Common Pitfalls to Avoid in Title Lending

- Safeguarding Your Rights: A Guide for Borrowers

Understanding Bedford Title Loans: The Basics

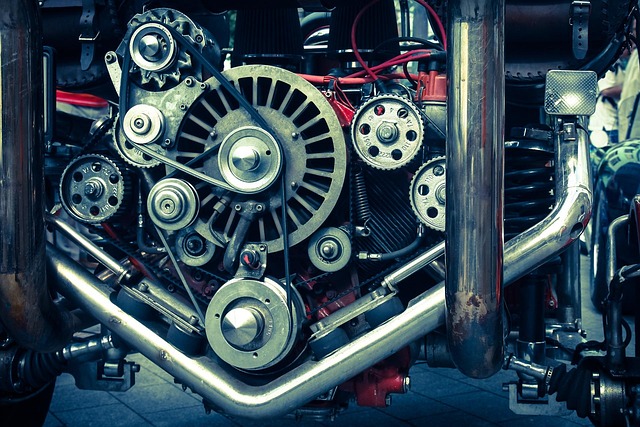

Bedford title loans are a form of secured lending where borrowers use their vehicle’s title as collateral. This type of loan is designed for individuals who need quick access to cash, often offering faster approval and more flexible terms compared to traditional bank loans. The process involves applying with a lender, providing necessary documentation, and using your car’s registration and title as security. Once approved, you’ll receive a loan amount, typically a percentage of your vehicle’s value.

Key aspects to consider include interest rates, repayment terms, and the potential for direct deposit of funds into your bank account. Some lenders also offer the convenience of an online application process for Bedford title loans, allowing borrowers to initiate the loan request from the comfort of their homes. However, it’s crucial to understand the terms, conditions, and associated fees before signing any agreements to avoid potential pitfalls. Car title loans, while providing a quick solution, can have significant consequences if not managed responsibly.

Common Pitfalls to Avoid in Title Lending

When considering Bedford title loans, it’s imperative to be aware of potential pitfalls that can lead to financial strain. One common mistake is rushing into a decision without fully understanding the terms and conditions. Title lending often involves complex agreements, and a hasty choice may result in unfavorable interest rates or hidden fees. Always take time to read and comprehend the contract.

Another trap to avoid is securing a loan based solely on the promise of quick approval. While speed is an attractive feature, especially for those needing immediate funds, it can be a red flag. Lenders offering prompt approvals might charge higher rates or have less stringent eligibility criteria, potentially leading to longer-term debt. It’s better to focus on reputable lenders who provide transparent terms and fair interest rates, even if the approval process takes slightly longer. Additionally, opting for motorcycle title loans as an alternative can be risky; these loans use your vehicle’s title as collateral, leaving you vulnerable if you fail to make payments. As a responsible borrower, consider only reputable lenders who offer no credit check options, ensuring a safer borrowing experience.

Safeguarding Your Rights: A Guide for Borrowers

When considering Bedford title loans, it’s imperative to prioritize your financial security and know what to look out for to avoid pitfalls. These types of loans use your vehicle title as collateral, so understanding the terms is crucial. Before signing any paperwork, ensure you’re comfortable with the interest rates and repayment conditions offered by the lender. The loan amount will depend on your vehicle’s vehicle valuation, so get several appraisals to ensure you’re getting a fair price for your asset.

Remember, you have rights as a borrower. Lenders must provide transparent information about fees, charges, and the overall cost of the loan in terms of both principal and interest. If something feels off or unclear, don’t hesitate to ask questions or seek advice from trusted financial sources. A thorough understanding of your rights and obligations is key to making an informed decision regarding a Bedford title loan.

When considering Bedford title loans, it’s crucial to be aware of potential pitfalls to ensure a safe and fair borrowing experience. By understanding the basics, recognizing common traps, and safeguarding your rights as a borrower, you can make informed decisions. Remember, while Bedford title loans can offer quick funding, responsible borrowing is key to avoiding long-term financial strain.